Managing the open enrollment process effectively

Open enrollment season can be a challenging time for both employers and employees. It's a critical period when employees select their benefits for the upcoming year, including dental, vision, and life insurance. Managing this process effectively can save time, resources, and reduce stress for everyone involved. Read more to gain valuable guidance on streamlining the open enrollment process for these essential insurance plans.

Start early and communicate clearly

.Effective open enrollment begins with clear communication and ample time for planning. Inform your employees well in advance about the upcoming open enrollment period. This gives them time to review their options and make informed decisions.

Use multiple channels to communicate the details of the enrollment process, including email, company newsletters, meetings, and even webinars. Make sure employees understand the key dates and any changes to the plans.

According to an article from SHRM, it is recommended that employees ask the following questions to help select the coverage options that are right for them. As a business owner, you can be proactive in providing this information to your employees. Some questions include:

- Has the employer's prescription drug coverage changed?

- Has the employer changed administrators for benefits?

- Has the employer added new or expanded voluntary benefits?

To effectively engage a diverse workforce with different learning styles and work environments, it is essential to utilize various delivery methods and content formats. By doing so, employers can significantly increase the chances of reaching and connecting with employees in a meaningful way. This approach acknowledges that individuals have distinct preferences when it comes to learning - some may prefer reading, while others may be more inclined towards visual content or in-person/virtual meetings. By offering a range of options, employers ensure that information is accessible to all and delivered in a manner that makes an impact.

Simplify plan options

Offering a multitude of insurance plan options can overwhelm employees and make the enrollment process complex. Consider simplifying your offerings.

Core Plans: Provide a set of core insurance plans that cover the essential needs of most employees. These can include a standard dental, vision, and life insurance plan.

Additional Options: Offer additional coverage options for employees who want more comprehensive benefits. This might include orthodontic coverage in dental insurance or supplemental life insurance.

Provide education and resources

Invest in user-friendly online tools and resources to streamline the enrollment process:

- Digital Platforms: Utilize user-friendly online enrollment platforms that allow employees to compare plans, calculate costs, and make selections with ease.

- Benefit Calculators: Offer benefit calculators that help employees estimate their premium costs and potential out-of-pocket expenses based on their needs.

Educating employees about their insurance options is crucial for effective enrollment. Designate a point of contact or a team to assist employees throughout the enrollment process. This can include answering questions, troubleshooting issues, and providing guidance through:

- Information Sessions: Host informational sessions or webinars to explain insurance plan options, benefits, and any changes from the previous year.

- Q&A Sessions: Provide opportunities for employees to ask questions and get clarification on insurance-related topics.

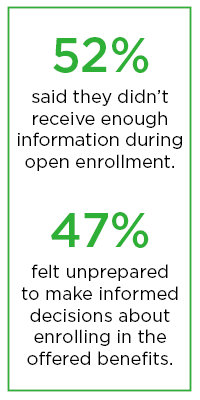

According to a study done by LegalShield, 52% of people surveyed stated they didn't receive sufficient information during open enrollment. Additionally, 47% reported feeling unprepared to make informed decisions about enrolling in the offered benefits. This suggests a lack of awareness about provided coverage through benefit plans, and may lead to uninformed decisions and decreased participation.

Deadline management

Clearly communicate enrollment deadlines and stick to them. Send regular reminders as the enrollment deadline approaches to ensure employees don't miss the opportunity to select or change their coverage. Consider offering a brief grace period after the official enrollment deadline for employees who need extra time to make their selections.

Don't forget about post-enrollment support. Send confirmation emails to employees once they've completed their enrollment to provide peace of mind. Additionally, consider offering year-round support for employees who experience life changes (e.g., marriage, childbirth) and need to adjust their coverage.

Final Thoughts: Managing the open enrollment process effectively

Managing the open enrollment process effectively for dental, vision, and life insurance requires careful planning, clear communication, and the use of user-friendly tools and resources. By simplifying the options, providing education and support, and automating processes, you can save time and resources while ensuring that your employees make informed decisions about their insurance coverage. A well-organized open enrollment process benefits both your company and your employees by ensuring that everyone gets the most out of their insurance plans.